Definition of COGS #

Cost of Goods Sold (COGS) refers to the direct costs associated with the production or acquisition of goods that a business sells within a specific accounting period. It includes the costs of raw materials, labour directly involved in production, and any other direct expenses that contribute to the creation of the product. COGS is a crucial component in determining a business’s gross profit, as it reflects the expense directly tied to revenue generation.

Example of COGS Calculation #

Let’s consider a retail business with the following data:

Beginning Inventory: $10,000

Purchases during the year: $25,000

Ending Inventory: $5,000

COGS is calculated using the formula: #

COGS = Beginning Inventory + Purchases − Ending Inventory

In this case:

COGS = 10,000 + 25,000 − 5,000 = 30,000

So, the business’s cost of goods sold for the year is $30,000.

What is Included in COGS #

COGS includes any direct costs tied to the production or procurement of the goods that a business sells, such as:

Raw Materials: The materials needed to manufacture a product.

Labor Costs: Wages paid to workers who are directly involved in producing goods.

Shipping and Handling: Freight or shipping fees for raw materials or inventory.

Manufacturing Costs: Any costs associated with the manufacturing of goods, like factory overhead.

What is Not Included in COGS #

COGS does not include indirect expenses such as:

Administrative Expenses: Office rent, utility bills, or salaries for non-production staff.

Marketing and Sales Costs: Expenses related to promoting or selling the goods.

Depreciation: Though related to assets, general depreciation is not included in COGS unless it directly impacts production.

Standard Flow for Calculating COGS #

Determine Beginning Inventory: This is the value of inventory on hand at the start of the period.

Add Purchases: Include the cost of goods or raw materials bought during the period.

Subtract Ending Inventory: This is the value of inventory left at the end of the period.

COGS Formula:

COGS = Beginning Inventory + Purchases − Ending Inventory

This formula gives you the total cost of the goods sold during that period, directly impacting your gross profit.

How SyncTools is calculating a COGS From Linnworks? #

This document provides a clear overview of how SyncTools calculates the Cost of Goods Sold (COGS) based on different sync frequencies and purchase price configurations.

Sync Frequencies? #

SyncTools calculates COGS based on three sync frequencies:

Daily Basis

SyncTools processes all sales orders from the previous day.

COGS is calculated using the purchase price from each sales order line item.

Weekly Basis

SyncTools aggregates sales data over a week.

Provides a broader view of COGS for businesses with moderate transaction volumes.

Monthly Basis

SyncTools calculates COGS based on a month’s worth of sales.

Best for businesses with lower transaction frequencies.

Purchase Price Configuration #

Which purchase value do you want us to sync? #

You can choose from the following options:

Average Stock Value ? #

Calculates the average stock value based on stock movements.

Example:

1. If a stock item has a purchase price of $10 and a retail price of $15, and the inventory is 100 units, the total stock value is:

Total Stock Value = 100 units * $10 = $1000.

2. Average stock value is calculated as:

Average Stock Value = Total Stock Value / Total Stock Quantity = $1000 / 100 = $10 per item.

3. If you then purchase an additional 50 units at $15:

New total stock quantity = 100 + 50 = 150 units.

New total stock value = $1000 + (50 * $15) = $1000 + $750 = $1750.

Updated average stock value = $1750 / 150 = $11.67 per item.

Average Stock Value or Purchase Price

This option allows for a calculation that takes into account both the average stock value and the static purchase price.

Purchase Price

COGS will reflect the static purchase price specified in the inventory item.

This option is useful for items with fixed pricing.

Conclusion

Using SyncTools for calculating COGS ensures accurate and efficient inventory management. Select the appropriate sync frequency and purchase price configuration that aligns with your business needs for optimal financial reporting. ?

?️ COGS in SyncTools with Linnworks Integration #

In SyncTools, COGS is calculated based on processed sales orders and the average stock value of inventory items retrieved from Linnworks. SyncTools provides a seamless way to sync this data with accounting platforms like Xero and QuickBooks.

COGS Configuration in SyncTools #

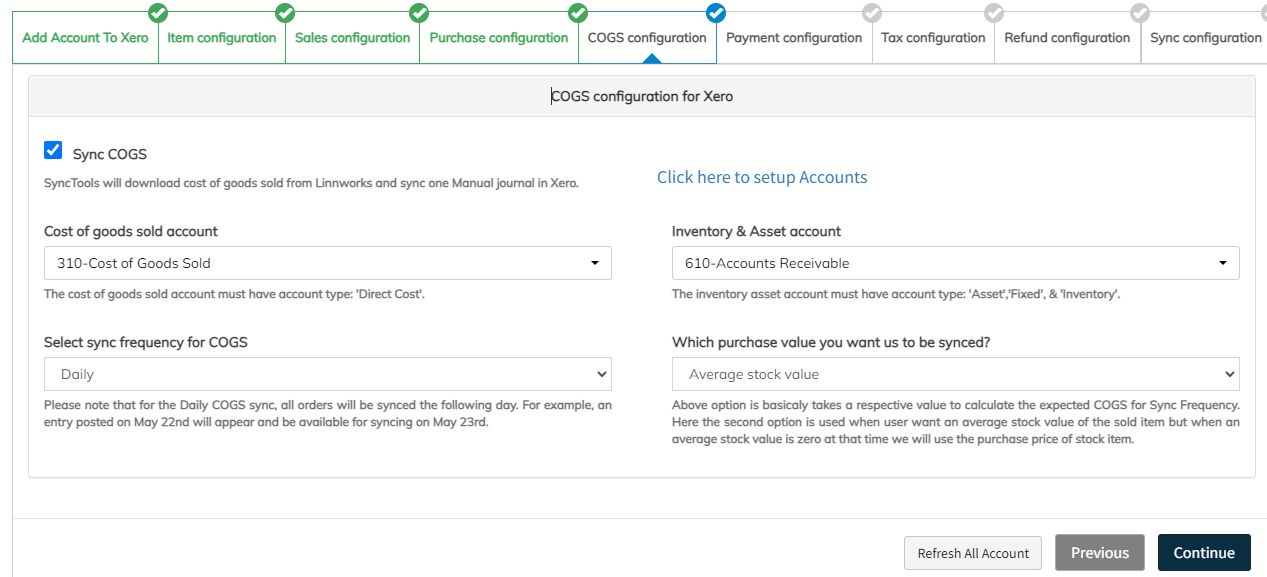

SyncTools offers a straightforward configuration for managing COGS:

1. Sync COGS Checkbox: #

When you check the “Sync COGS” checkbox, you are presented with four dropdown options:

Cost of Goods Sold Account: Select the account from Xero or QuickBooks where the total COGS amount will be debited (typically a purchase account).

Inventory Account: Select the inventory account from Xero or QuickBooks where the balance will be adjusted.

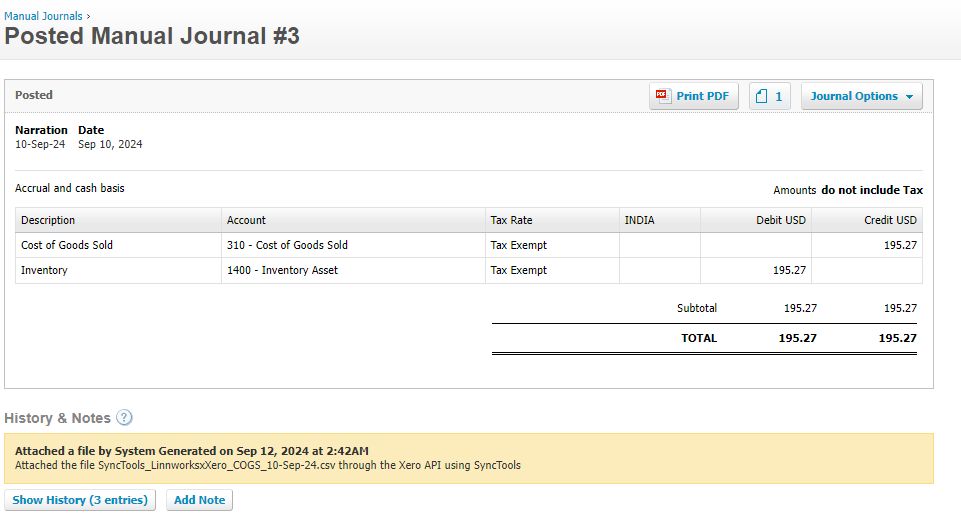

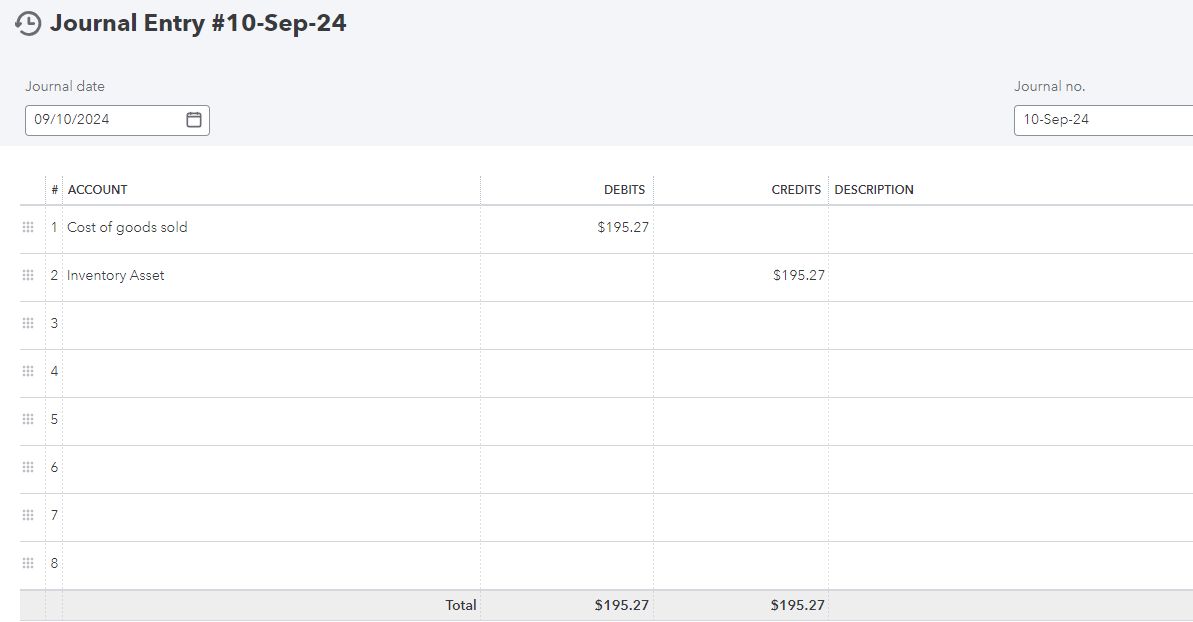

2. SyncTools creates a journal entry in QuickBooks for the COGS or a posted manual journal in Xero, attaching a CSV file containing the details of the journal.

3. Sync Frequency:

In the second row of options, you can set how often SyncTools will sync COGS:

Daily

Weekly

Monthly

4. This frequency determines how often SyncTools fetches processed sales orders from Linnworks and calculates the COGS based on that data.

5. Purchase Value Selection:

You also have the option to choose the purchase value for calculating COGS:

Average Stock Value (default)

Average Stock Value or Purchase Price

Purchase Price

6. This dropdown allows businesses to choose between using the average stock value or the purchase price as the basis for calculating COGS. While the standard method is to use the Average Stock Value, some clients prefer to use the Purchase Price for their inventory items.

7. The above option basically takes a respective value to calculate the expected COGS for Sync Frequency. Here the Average Stock Value or Purchase Price is used when user want an average stock value of the sold item but when an average stock value is zero at that time we will use the purchase price of the stock item.

Syncing Process #

Once the configuration is set up, SyncTools calculates COGS based on the processed sales orders from Linnworks. The frequency selected (daily, weekly, or monthly) dictates how often SyncTools retrieves and calculates the COGS data, ensuring accurate and timely reporting to QuickBooks or Xero.

By offering flexible configuration options and syncing COGS with accounting platforms, SyncTools makes managing COGS an effortless and automated process for businesses.

In summary, COGS is vital for understanding a business’s direct costs associated with producing goods. SyncTools integrates smoothly with Linnworks, QuickBooks, and Xero to automate COGS calculations, providing efficiency and flexibility for businesses.

Advanced COGS Calculation Feature #

The Advanced COGS (Cost of Goods Sold) Calculation feature offers a more precise way of calculating COGS based on specific configurations within SyncTools. This feature is designed to handle complex scenarios involving sales channels, sources, and subsources.

Key Configurations #

1. Sync Sales Orders for Selected Channel Only

When enabled, SyncTools will synchronize sales orders exclusively for the selected sales channel.

2. Enable Sales Order Filter by Custom Source

When this option is activated, SyncTools will filter sales orders based on custom-defined sources and subsources.

Advanced COGS Calculation #

If Advanced COGS Configuration is enabled, COGS will only be calculated for orders that match the defined source and subsource in the above configurations. SyncTools will assess each processed sales order to determine whether it matches the sales channel or custom source/subsource setup. If a match is found, COGS will be calculated for those processed orders only.

Configuration Help: #

When set to ON, SyncTools utilises the processed sales order’s source and subsource to verify if it aligns with the selected sales channel or custom source/subsource configuration.

Only those processed orders that meet the criteria will have their COGS calculated.

By using this feature, you ensure that the COGS calculation is accurate and tailored to specific channels or sources, enhancing control over your financial reporting.

Snapshots of Created COGS in Xero and QuickBooks. #

1) Posted manual journal in Xero: #

2) Journal entry in Quick Books: #

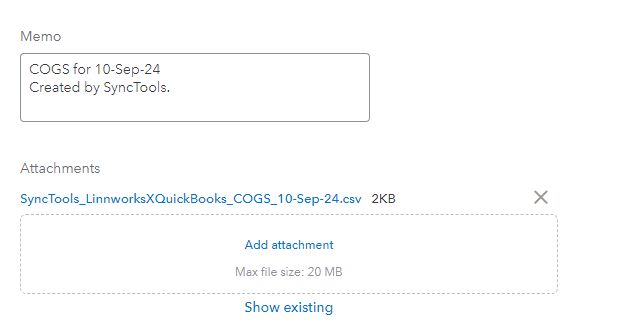

And the attachment will look like this…